A breakdown of the changes to Land Transaction Tax in Wales

Recently, Finance Minister, Rebecca Evans, announced the new temporary changes to Land Transaction Tax (LTT) in Wales. As of 27 July 2020, any properties valued up to £250,000 will require no LTT to be paid. These changes will apply and run up until 31 March 2021.

New temporary changes explained

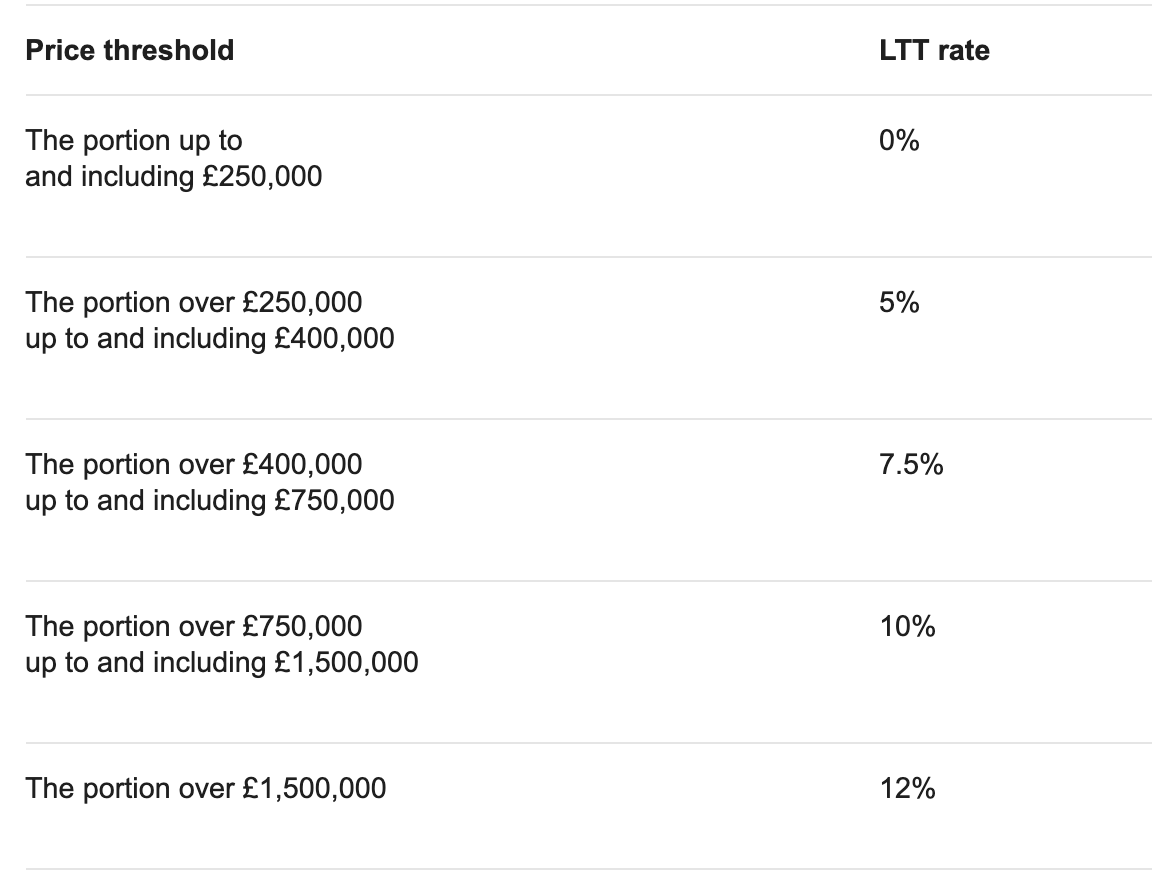

Prior to 27 July 2020, there is no tax payable on properties in Wales valued up to £180,000. The Government will now extend this threshold to £250,000. The rates then increase to 5% up to the property value of £400,000, 7.5% up to £750,000, 10% up to £1,500,000 with any amount thereafter taxed at 12%.

Visit gov.wales for more information

Second homes and buy-to-let investments

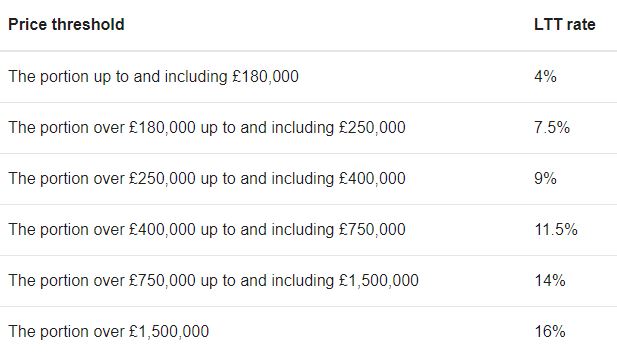

A 4% surcharge applies to all transactions on or after 22 December 2020, involving the purchase of an additional property. This includes second homes and buy-to-let investments. The surcharge applies to the full purchase price above an initial threshold of £40,000.

Visit gov.wales for more information

If you are replacing your main residence, the higher rates may not apply.

Specific first-time buyer relief is not currently available under the LTT system.

Find out how much LTT you will need to pay on your new home via our Online Calculator.

If you are looking to buy or sell your home today, contact your local Guild Member today.